Nonetheless, between the ninth and tenth of Could, the UST’s value crashed, falling beneath ten cents and fully shedding its peg. Earlier than its decoupling from USD, UST was the third-largest stablecoin by market cap. This makes the collapse one of the vital developments in crypto and one thing that everybody fascinated with blockchain wants to know.

Why did UST, which has been so steady for thus lengthy, decouple? What are the results?

Algorithmic Stablecoins Are Completely different from Different Stablecoins

Earlier than analyzing UST’s decoupling, let’s take a look at the way it differs from the authorized and over-collateralized stablecoins.

- Algorithmic stablecoins don’t require any collateral. They as a substitute regulate the variety of tokens held by customers by way of forex value fluctuations.

- Fiat and over-collateralized cash require collateral. For instance, Tether (USDT) holds collateral in fiat USD. Hyper-collateralized cash use BTC and ETH as collateral. Due to the excessive value volatility of BTC and ETH, the collateral has to be over-collateralized.

UST is a stablecoin anchored to $1, however without enough collateral belongings. As soon as the token value fell beneath $1, its entire ecosystem, together with LUNA and the Anchor protocol, had been dragged down with it.

UST’s Decoupling: Earlier than and After

UST token value steady at $1

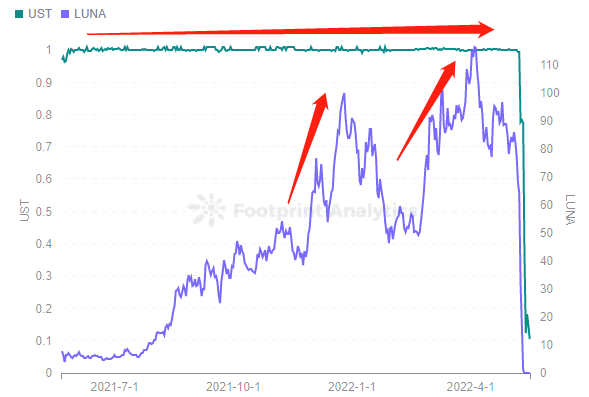

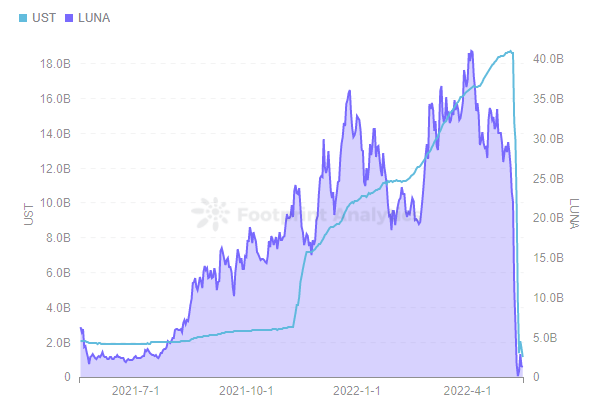

Footprint Analytics knowledge exhibits that UST was steady at around $1 for about 1 yr, from Could 27, 2021 to Could 8, 2022. Throughout this time, LUNA’s value has seen 2 main will increase, peaking at $116.32.

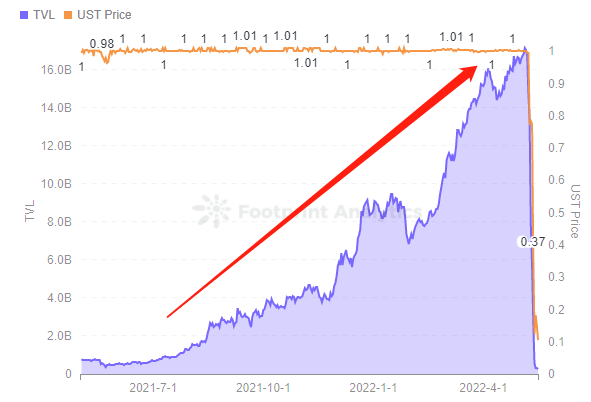

The soundness of UST on the $1 anchor was the driving pressure behind the expansion of Terra’s ecosystem.

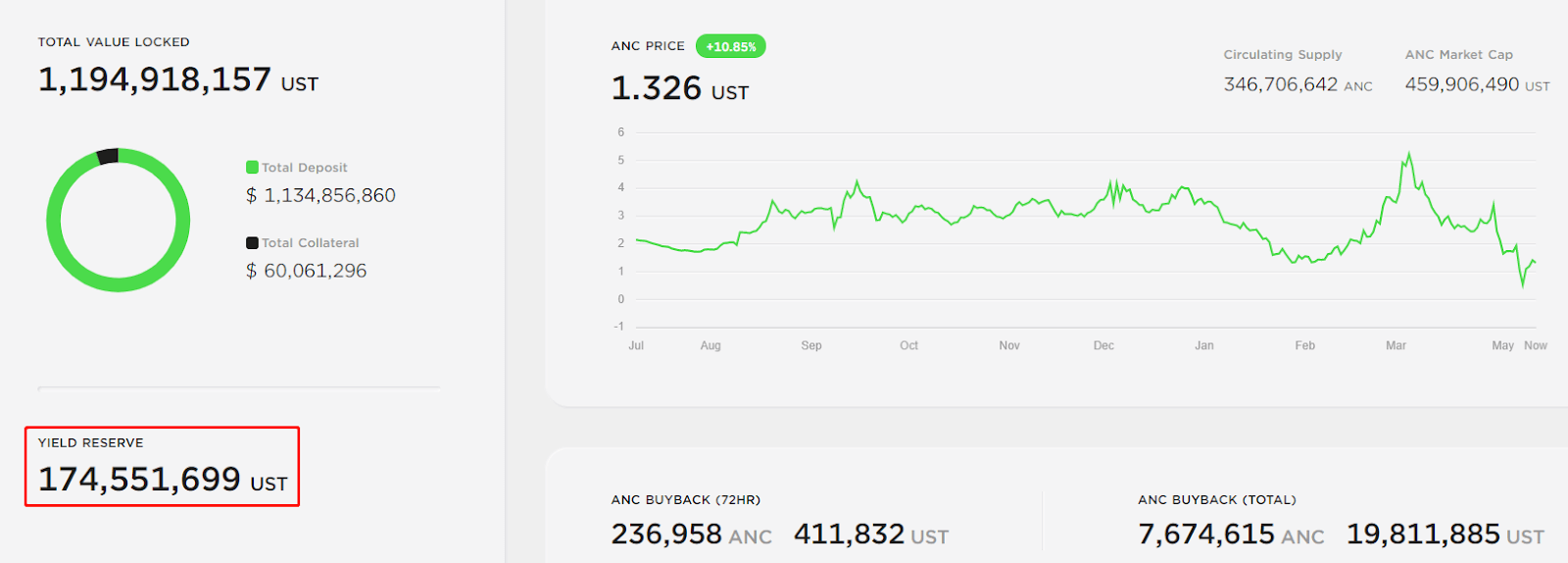

- The liquidity of the Anchor protocol up to now accounted for 50% of Terra TVL, and the steady storage revenue supported the soundness of UST at $1. It supplied greater than $267 million in UST earnings reserves, which allowed customers to earn 20% APY by depositing UST on the protocol—a lot greater than returns from different stablecoins. Excessive yields are a giant issue driving stablecoin demand and likewise led to Anchor attracting $17.2 billion in TVL.

- The Luna Basis Guard (LFG) was established in January 2022 to assist the soundness of the UST and facilitate the event of the Terra ecosystem. In February, it raised $1 billion in financing from a number of VCs by way of the sale of LUNA, backed by BTC to assist anchor UST and develop the Terra ecosystem.

Nonetheless, these mechanisms and reserves weren’t sufficient to maintain the soundness of UST.

Why did UST decouple?

The value of UST fell from $1 on Could 8 to around $0.18 on Could 14. It briefly bounced again up, teasing that maybe the mechanism can be resilient sufficient, however then resumed its crash.

As of Could 16, UST seems to be useless and has killed the market’s confidence in algorithmic stablecoins as nicely.

What occurred?

- A large whale offered a $285 million price of UST on Could 7. This was the set-off that prompted the decoupling of the UST from the greenback.

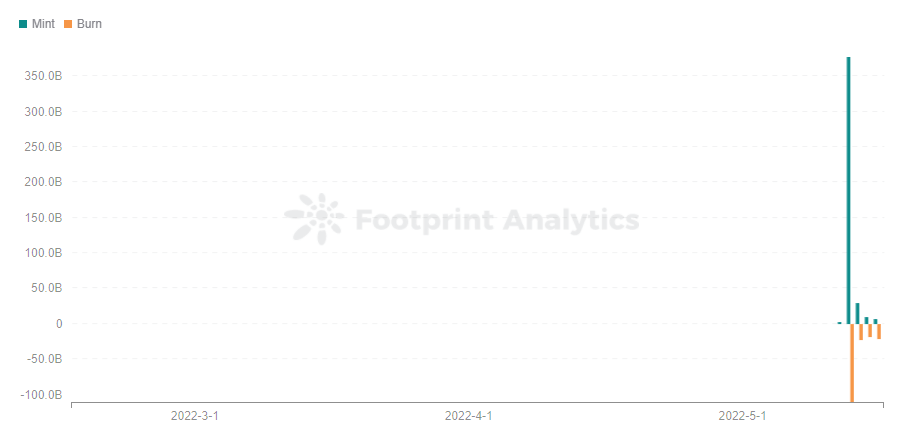

- As UST misplaced its peg, LUNA began printing. It is because customers abandon the decoupled USTs of their palms, leading to extra minting of LUNA, which triggers a deeper drop in LUNA.

- Nonetheless, the devaluation of LUNA occurred so shortly that it was merely unable to purchase again sufficient UST to repeat it to $1.

- Each LUNA and UST crashed to cents.

- Anchor, which depends on the Terra Fund to repeatedly replenish its reserves to cowl the 20% APY additionally crashed.

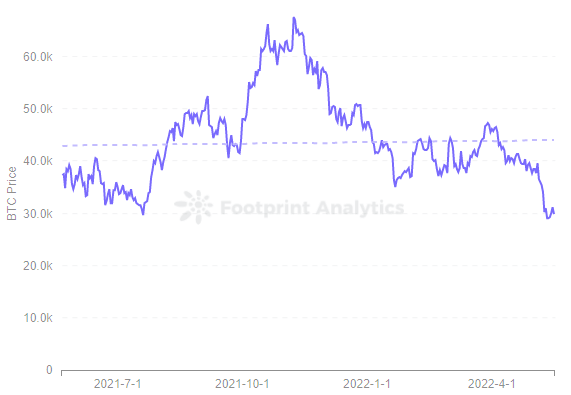

- LFG’s reserve of BTC was purported to function as a backstop to assist anchor the UST. Nonetheless, the value of BTC has been falling since its peak in November’s final yr. As of Could 16, the value of BTC has fallen beneath $30,000.

This has an adverse effect on the anchoring of UST and the event of the Terra ecosystem.

- UST is totally different from fiat forex stablecoins and doesn’t have enough collateral belongings.

How the Collapse of UST Worth Drop Impacts the Terra Ecosystem and Crypto

With its precipitous collapse, the Terra ecosystem seems to be useless.

With UST beneath $1, the value and market confidence in Terra’s native token, LUNA, collapsed. Footprint Analytics knowledge exhibits that the drop in LUNA’s token value and the fast abandonment of UST by UST holders led to extra Minting of LUNA, which triggered a good deeper drop in LUNA. As of Could 16, LUNA’s token value fell beneath $0.11 from a peak of $116.32, a 99.9% drop in lower than a month.

The market cap of UST and LUNA has inverted, with LURA’s market cap being smaller than UST’s. When LUNA falls, enough liquidation area is usually reserved to keep away from excessive conditions of insolvency. Now the market cap has fallen off a cliff to $1.2 billion for LURA and $1.15 billion for UST. This drop may simply trigger confidence to break down and a demise spiral to happen.

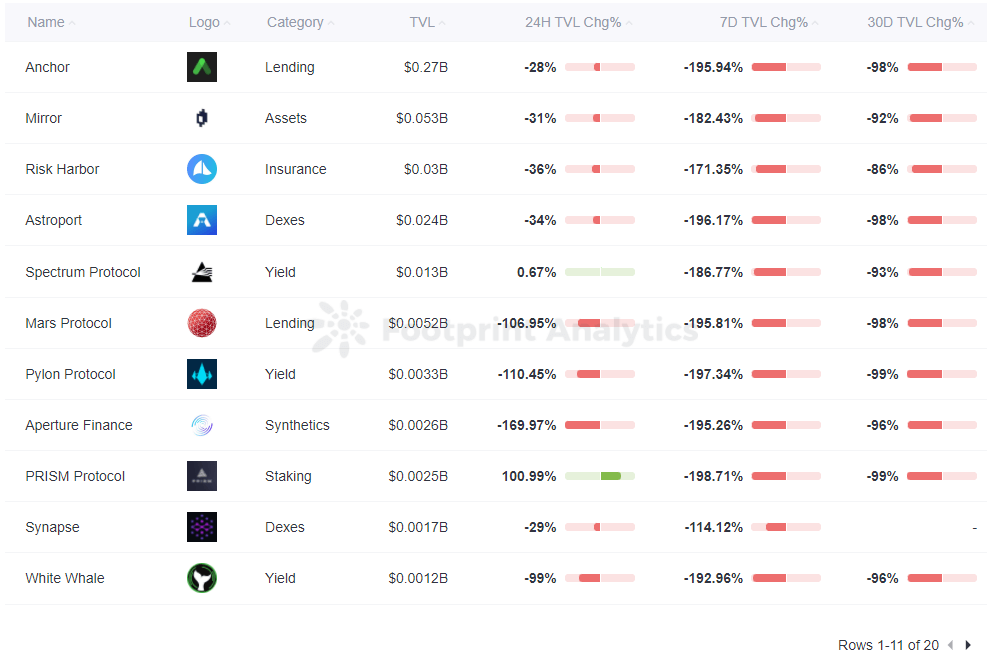

In fact, along with the forex value, market cap, and different indicators being affected, there are additionally Terra ecosystem protocols TVL displaying adverse progress. Particularly for protocols corresponding to Anchor and Lido, TVL has dropped by greater than 100%. Anchor is essentially the most affected by the algorithm steady forex UST, whereas Lido is affected by the drop within the value of LUNA.

Abstract

The present market panic remains to be spreading, the algorithmic stablecoin UST is severely unanchored, and the LUNA token value has appeared to take a catastrophic hit. Whereas its survival doesn’t appear possible, loopy issues can occur within the crypto world.

Date & Creator: Could. 2022, Vincy

Knowledge Supply: Footprint Analytics – Algorithmic Stablecoin Analysis

This piece is contributed by Footprint Analytics neighborhood.

The Footprint Group is a spot the place knowledge and crypto lovers worldwide assist one another to perceive and achieve insights about Web3, the metaverse, DeFi, GameFi, or every other space of the fledgling world of blockchain. Right here you’ll discover lively, various voices supporting one another and driving the neighborhood ahead.

What’s Footprint Analytics?

Footprint Analytics is an all-in-one evaluation platform to visualize blockchain knowledge and uncover insights. It cleans and integrates on-chain knowledge so customers of any expertise degree can shortly begin researching tokens, initiatives, and protocols. With over a thousand dashboard templates plus a drag-and-drop interface, anybody can construct their very own personalized charts in minutes. Uncover blockchain knowledge and make investments smarter with Footprint.